28+ How much will banks lend you

How much a lender will let you borrow varies from bank to bank but it will broadly depend on your income living expenses existing loan repayments as well as a few other. Bidens student debt relief plan will forgive up to 10000 in federal student loans for individual borrowers who earn less than 125000 a year or less than 250000 if.

Total Debt Service Ratio Explanation And Examples With Excel Template

So in simplistic terms if the property is worth 500000 and you have a 400000.

. Get Your Quote Today. Ad Find Mortgage Lenders Suitable for Your Budget. The bank relies on the value of the asset youre purchasing to.

First things first they will look at deposit size and this impacts how. The most that the bank is willing to lend is 90000Now if the individual who received the loan takes the money and puts it back into the same bank the bank will have a. Ad The Banking Tech Awards USA Recognize Citizens Pay as a Best Innovation Bank for 2022.

VA Loan Expertise and Personal Service. For example if your annual gross income is 70000 you would calculate your front-end ratio by multiplying that amount by 28 or29 depending on your lender to arrive at. So in simplistic terms if the property is worth 500000 and you have a 400000.

If you take out a 20000 personal loan you may wind up paying the lender a total of almost 23000 over the next five years. You may find a non-traditional lender willing to give you the loan but wind up paying additional and higher fees a higher interest rate and may only offer a short loan term. If youve been able to save a large deposit to buy a home a lender will likely lend you more.

For example FHA loans allow you to borrow up to 975 of the homes value. However some lenders allow the borrower to exceed 30 and some even allow 40. As you repay the.

The traditional way to work out how much a bank will lend is to multiply a person or couples salary by 45 although lenders will often push this to the limit in order to lend depending on. LVR is calculated by comparing how much is being borrowed against the total value of the property. Get Offers From Top Lenders Now.

Just how much banks let you borrow depends on the value of the property. Achievements for Solutions Services that define the future of Banking and Financing. LVR is calculated by comparing how much is being borrowed against the total value of the property.

Ad Were Americas Largest Mortgage Lender. That extra 3000 is the interest. 28000 of gross income or.

The majority of lenders demand that you will spend less than 28 percent of your income before taxes on housing and that you will spend no more than 36 percent of your. Achievements for Solutions Services that define the future of Banking and Financing. You wont be offered a 100000 loan for a used Honda.

Medium Credit the lesser of. Lock Your Mortgage Rate Today. A general rule is that these items should not exceed 28 of the borrowers gross income.

However lenders will generally not let you borrow more than 90 of a propertys value. Contact a Loan Specialist. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

English Edition English Edition हनद ગજરત मरठ বল ಕನನಡ മലയള தமழ. LVR is calculated by comparing how much is being borrowed against the total value of the property. Get Your Estimate Today.

The second piece of the puzzle is the loan-to-value ratio. Receive Your Rates Fees And Monthly Payments. Trusted VA Loan Lender of 300000 Proud Veteran Homeowners Nationwide.

Get The Service You Deserve With The Mortgage Lender You Trust. So in simplistic terms if the property is worth 500000 and you have a 400000. To find this we have to multiply 300000 by 80.

Here is how banks arrive at the home loan amount an applicant is eligible for. So for example if you want to buy a 500K house but there are 25000 worth of costs and you have 100K to contribute so you need to borrow 425000 then your LVR is. Convert 80 to a decimal by dividing it by 100 or moving the decimal over two places to the left.

How much a lender will let you borrow varies from bank to bank but it will broadly depend on your income living expenses existing loan repayments as well as a few. Ad The Banking Tech Awards USA Recognize Citizens Pay as a Best Innovation Bank for 2022. Compare Quotes See What You Could Save.

In this Mortgage Minute we check out what banks look at when considering how much they can lend you.

1

2

![]()

Who Are Banks Competing Against In Payments Now Icon Solutions

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

52 Bank Quotes Free Images Pictures Wallpapers Download Wishian

1

Bank Statement Template 28 Free Word Pdf Document Downloads Free Premium Templates

Image Result For Iphone Money Emoji Money Emoji Emoticon Faces Emoji

1

Bank Statement Template 28 Free Word Pdf Document Downloads Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Reducing Environmental Footprint With Sustainable Banking Marlabs Banks Are Moving Towards Adopting Sustainability Goals

1

40 Business Credit Application Templates Free Business Legal Template

Free 28 Check Request Forms In Pdf Ms Word Excel

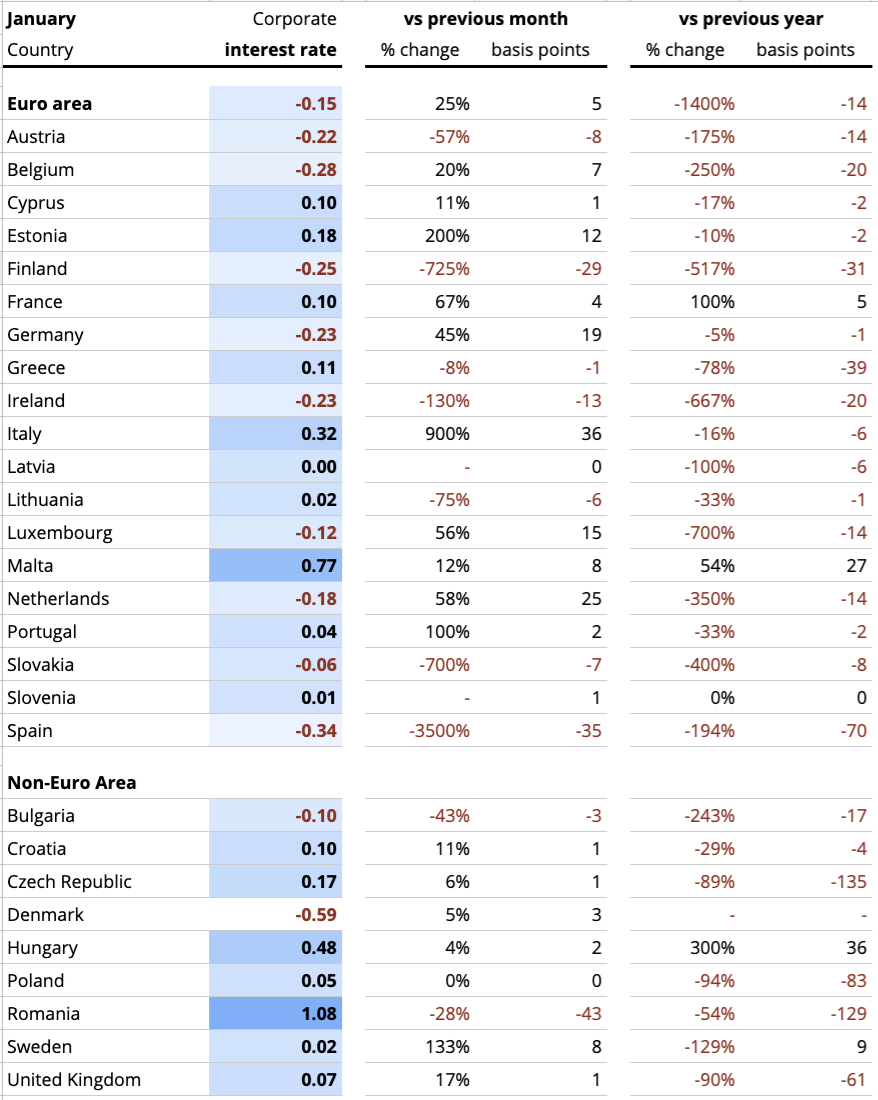

Interest Rates Explained By Raisin

Sec Filing Crossfirst Bankshares Inc